Making AI Mandatory: Will England - Walleye Capital

Community Wisdom - Sharing the best that we find

“If you don’t know how to use these tools or you’re not at a firm that gives you access to the tools to give you operating leverage, then you’re going to be obsolete.” —Will England

Introduction

Coming across this interview Will England did with Dan Shipper pushed me over the edge. I couldn’t shake the idea for AInvestor all spring, but after listening to their conversation I was finally moved to action. Dan proves to be an excellent interviewer, and in Will, he has a guest who speaks with clarity and conviction. Hopefully, we’ve done them justice. What follows are the three styles of summaries we use, each offering a different angle on the material. Any mistakes herein are ours.

Will England - Managing Partner, CEO and CIO of Walleye Capital

Will sets the strategic direction at Walleye, overseeing strategy allocation, risk, and talent. He began his career as a quantitative researcher at Man Group’s AHL division and later worked as an analyst at Valor Equity Partners. A graduate of Princeton (BSE in Operations Research and Financial Engineering, Academic All-Ivy) and Oxford (Master’s in Mathematical and Computational Finance), Will also rowed internationally for the U.S. National Team and won the Oxford-Cambridge Boat Race.

I have never met Will, but was duly impressed when I first listened to his interview with Patrick O’Shaughnessy a couple of years ago on the Invest Like The Best podcast. They cover the world of multi-strategy hedge funds and get more into Will’s backstory.

Dan Shipper - co-founder and CEO of Every

Dan is the co-founder and CEO of Every, a media and product company focused on business and AI. He runs an AI-first operation, writes the weekly Chain of Thought column, and hosts the AI & I podcast. Before Every, he founded the enterprise software startup Firefly, which he sold to Pegasystems. Today he’s best known for practical playbooks on how to use AI to think, write, and build.

He sounds like our kind of guy.

One of our motivations for starting AInvestor was to create a reason to actively engage with AI in an operational setting—learning by doing. I maintain active editorial oversight of instruction, model, and platform choices, but almost everything in the summaries below was written by AI. In the context of what we’re doing, I see this as a feature, not a bug. By experiencing the highs, and yes, the lows, we can better understand both the possibilities and the limitations of this new generation of AI.

Click above to access a custom GPT we spun up to help clean up our own writing. It’s designed to apply the lightest of touches. If you’re a paying ChatGPT customer, it’s free to use (we don’t get a cut). Feel free to play around with it as much as you’d like.

Learnings & Takeaways

In this interview, you’ll learn:

Why Walleye Capital made AI usage mandatory across all departments

How Will England leverages large language models (LLMs) to sharpen thinking and communication

What Walleye’s internal AI platform “Current” does for analysts during earnings season

Why England sees AI adoption as a responsibility to employees and investors alike

How cultural rituals—like AI leaderboards and weekly meetups—accelerate adoption

Why he records nearly all firm communications and envisions a “Borg-like” collective data lake

What lessons history—railroads, barbed wire, and robber barons—offers about technological disruption

How incentives and intellectual honesty guide England’s decision-making framework

Why journaling with AI helps him track family, work, and health in harmony

How he frames leadership responsibility in an AI-driven world

Some takeaways:

AI adoption is not optional at Walleye. England mandated AI fluency across all 400 employees—whether in trading, compliance, or accounting—arguing that refusing AI is like refusing the internet in 1995.

Cultural design drives uptake. Walleye runs AI meetups, tool leaderboards, and incentive systems to normalize experimentation, making adoption social rather than top-down.

Internal tools deliver measurable edge. The “Current” platform synthesizes analyst notes, broker PDFs, and transcripts in real time—now indispensable for stock pickers during earnings.

AI reshapes leadership communication. England drafts memos in bullet points and uses LLMs to generate polished prose in minutes, freeing time for higher-order thinking.

Recording everything creates future leverage. By capturing calls, meetings, and transcripts, Walleye is building a “collective memory” that LLMs can process for insights and risk management.

History shows disruption accelerates. England draws parallels between AI and 19th-century railroads, barbed wire, and industrialization—technologies that rapidly obsoleted old skills.

First principles matter in decision-making. Incentives and intellectual honesty are England’s core anchors; he measures his own performance through journaling and tracked habits.

Responsibility is multi-layered. England views AI leadership as a duty: to investors (maximize returns responsibly), to employees (prepare them for change), and to his family (model adaptability).

AI journaling reduces friction. Capturing daily reflections across family, work, and health takes 30 seconds with AI, making the practice sustainable and insightful over time.

Human intuition and machine patterning complement each other. England argues that quant models and neural networks mirror intuition, and the future edge comes from combining them.

FAQs

Q1: Why did Walleye Capital make AI usage mandatory?

Framing AI Like the Internet

At Walleye, AI isn’t framed as a nice-to-have experiment; it’s considered a baseline competency on par with adopting the internet in the mid-1990s. Will England’s view is that ignoring AI today is like refusing to use email or Excel when they first appeared—an untenable position for anyone who expects to remain competitive in financial markets. That conviction led him to issue a firm-wide mandate: every employee, whether in trading, research, compliance, finance, or accounting, must learn to use AI tools fluently in their day-to-day work.

Sending a Cultural Signal

England made this directive explicit in a memo where he opened by saying, “I used ChatGPT to write this email. You should be using it too and be proud of it.” The message was not only symbolic but also practical. He wanted to strip away the lingering hesitation employees felt about AI—whether it was the fear of “cheating” or anxiety about job security—and replace it with a clear cultural norm: using AI is part of the job.

Competitiveness and Responsibility

In his eyes, it would be irresponsible for leadership to allow Walleye to fall behind when competitors are already moving quickly. By making adoption mandatory and leading by example, England aimed to give the firm an organizational edge, ensuring that every team member, regardless of role or technical background, benefits from the productivity lift AI offers.

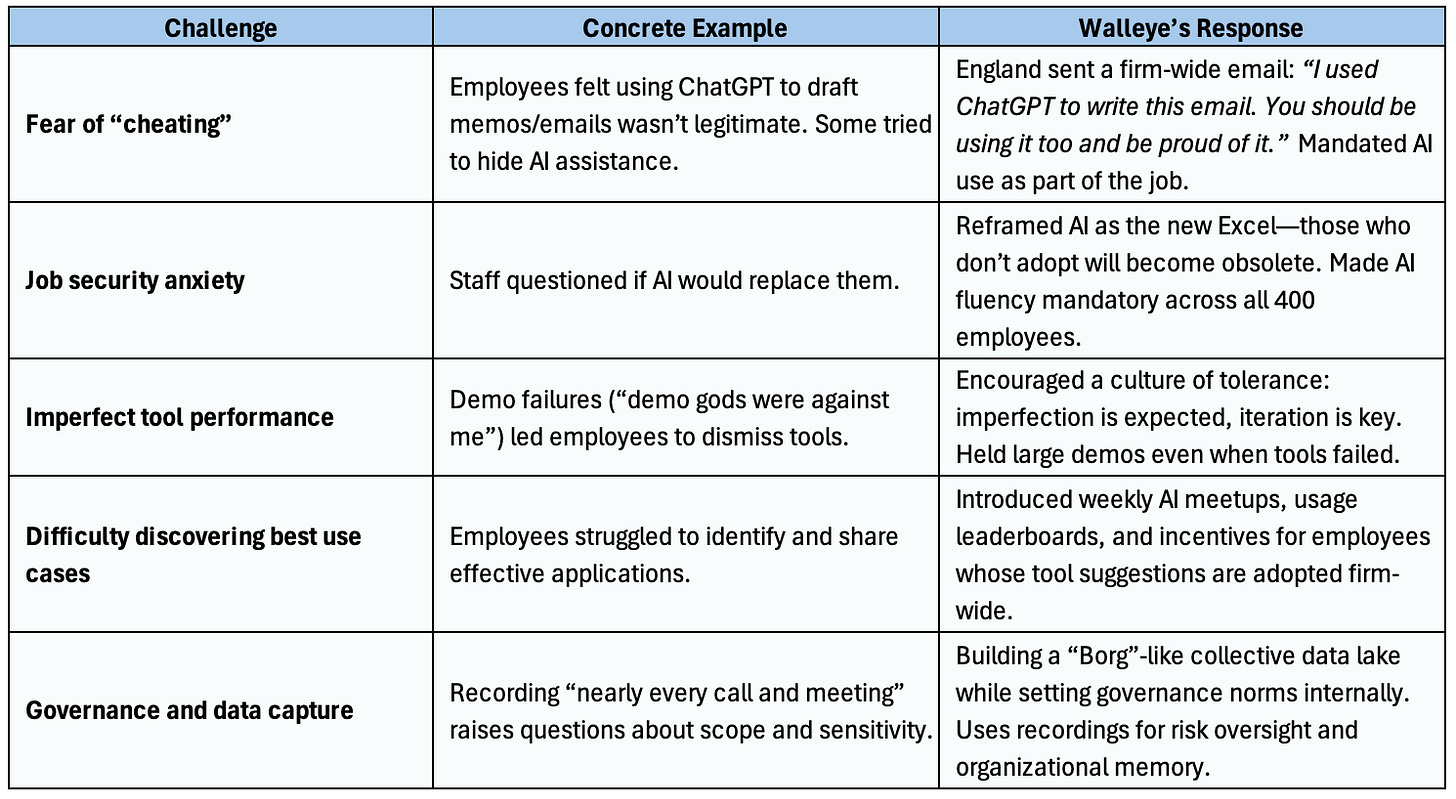

Q2: What are the top challenges Walleye has had with adoption or implementation?

Employee Fear of “Cheating”

Many employees initially felt that using ChatGPT to draft memos or emails was a form of cheating. Some even went so far as to edit or “dust up” AI-written drafts to hide the fact that they had used the tool. England confronted this stigma head-on by sending a firm-wide email that began, “I used ChatGPT to write this email. You should be using it too and be proud of it.” His intent was to normalize AI use and make it clear that adoption was not just acceptable, but encouraged as part of Walleye’s culture.

Anxiety About Job Security

There was also real concern among staff that AI might eventually replace their roles. England reframed this anxiety by emphasizing that AI doesn’t eliminate jobs, it changes them. He compared the shift to the arrival of spreadsheets: those who failed to learn Excel became obsolete, but those who did became more valuable. To reinforce this message, he mandated that every employee—whether in analysis, compliance, accounting, or another function—develop a baseline level of AI proficiency to stay competitive.

Imperfect Tools and User Frustration

Another hurdle has been the imperfection of the tools themselves. AI systems often make mistakes, and England recalled one demo where the “demo gods were against me” and everything failed in real time. Employees, frustrated by these errors, tended to give up on tools too quickly. England worked to shift the culture, encouraging staff to embrace imperfection, iterate, and keep experimenting. His message: the direction of travel is positive, even if the tools aren’t flawless today.

Discovery and Diffusion of Best Practices

England acknowledged that it’s hard for employees to discover the best AI use cases on their own. To address this, Walleye created structures that make sharing and discovery easier. Weekly AI meetups allow staff to exchange prompts and examples. Firm-wide leaderboards highlight heavy users and celebrate adoption. Incentives were also introduced so that employees who suggest tools that later roll out across the firm receive recognition. These steps transformed AI adoption from a solitary exercise into a social, collaborative effort.

Governance and Data Capture

Finally, governance around data capture remains a challenge. Walleye records nearly every call and meeting to build what England calls a “Borg”-like collective memory for the firm. While he views this as essential for long-term advantage, it raises questions about what should or shouldn’t be recorded and how to handle sensitive material. England recognizes that governance structures need to keep pace with this level of data capture, ensuring that trust and compliance aren’t compromised as the firm pushes forward.

Q3: What principles guide decision-making at the firm?

Power of Incentives

England emphasized that most human behavior in organizations can be explained through incentives. In investments, aligning incentives sheds light on why companies, management teams, or counterparties act the way they do. Inside the firm, structuring incentives ensures employees are moving in the same direction as both the firm and its investors. His litmus test is simple: “Are the incentive vectors all pointing in the same dimension?” If the answer is yes, decisions are more likely to succeed.

Intellectual Honesty

A second anchor is intellectual honesty. England has a strong distaste for fluff and empty rhetoric; the real question is whether an idea, analysis, or thesis holds up under scrutiny. Leaders at Walleye are expected to be candid about mistakes as well as successes. This kind of honesty acts as a safeguard against bias—especially relevant when using AI tools, which can produce outputs that look polished but may be misleading if not interrogated carefully.

Measurement and Feedback Loops

Another principle is the discipline of measurement. As England puts it, “you can’t manage what you can’t measure.” He applies this personally by journaling daily—now assisted by AI—and tracking his health and workouts as time series. The same philosophy applies at the firm level: track operational and investment data rigorously, revisit it over time, and use it to identify patterns and lessons that can refine decision-making.

Harmony Across Domains

Finally, England sees decision-making as spanning multiple domains. Instead of striving for strict “balance” between family, work, and health, he pursues “harmony.” Trade-offs are not judged only by their financial outcomes but also by how well they align with personal responsibilities and long-term sustainability. This integrated view ensures that decisions serve the whole, not just one isolated area of life or business.

Q4: What role does data capture play in Walleye’s AI strategy?

Creating a Collective Memory (“The Borg”)

Walleye records nearly every Zoom, phone call, and meeting with the explicit aim of building what Will England calls a “Borg”-like collective system—a firm-wide memory where nothing important is lost. The vision is to connect text data like emails, notes, and transcripts with numerical data such as market prices, accounting, and internal performance metrics, so that the firm can operate on a unified information base.

Risk Oversight and Decision Auditing

Daily risk calls are captured in full and then processed by language models. This allows the risk team, and leadership more broadly, to revisit not just what decisions were made but why they were made in context. By preserving the reasoning behind actions, the firm can spot blind spots, biases, or inconsistencies in decision-making over time, creating a feedback loop that strengthens risk oversight.

Enhancing Analyst and Portfolio Manager Productivity

Notes, broker PDFs, and earnings transcripts flow into Walleye’s internal tool, Current. This platform enables analysts and portfolio managers to instantly synthesize vast amounts of recorded information, rather than manually sorting through it. During earnings season in particular, the ability to pull together and process information in real time has become indispensable, freeing humans to focus on higher-order judgment while AI handles the heavy lifting.

Organizational Learning and Knowledge Retention

One of the less obvious but equally valuable benefits is the preservation of institutional knowledge. In most firms, when employees leave, their thought processes and reasoning walk out with them. At Walleye, recordings and transcripts capture those thought patterns, ensuring continuity for the organization and creating a training resource for new hires. Weekly meetups and demos also draw on this recorded material, turning data capture into an ongoing learning loop.

Future Vision: Full Data Lake Integration

England sees today’s recording practices as the foundation for a broader strategy. The long-term goal is to unify all data streams—structured and unstructured—into a single collective system. Once text and numerical data are connected in one place, AI can go beyond summarization to surface higher-order insights, such as linking the content of risk conversations to subsequent portfolio outcomes. In his view, this kind of predictive intelligence will define the firms that turn AI into a real operating advantage.

Q5: How does Walleye think about humans and machines working together?

Complementary Processing

At Walleye, the relationship between humans and machines isn’t viewed as a zero-sum competition but as a complementary partnership. Will England draws a parallel between human intuition and neural networks: both operate in high-dimensional spaces, processing complexity in ways that are difficult—sometimes impossible—to fully explain. Just as a seasoned investor may “feel” that a trade is right based on years of pattern recognition, a machine learning model can surface relationships across thousands of variables that no human could parse line by line. The two modes of reasoning mirror one another, and when combined, they open up possibilities that neither could achieve alone.

Extending Intuition

For England, the real opportunity lies in using machines to extend human intuition. Neural networks can highlight patterns or correlations that may feel intuitive once revealed but would have been nearly impossible for an analyst to uncover unaided. That doesn’t mean outsourcing judgment entirely. He stresses that tools are like engines—they need a plane to carry them somewhere.

Human Judgment Still Central

Humans still design the “plane”: setting objectives, framing problems, and ultimately deciding what to do with the machine’s output. In this way, AI becomes less about replacing decision-makers and more about expanding their cognitive reach, giving portfolio managers and risk teams access to insights that would otherwise stay hidden in the noise of markets and information flow.

Q6: What historical parallels inform England’s view of AI?

Railroads and Industrialization

England often looks back to the late 19th century for perspective. He points to the railroads, barbed wire, and the wave of industrialization as examples of technologies that reshaped the economy almost overnight. Railroads connected markets that had once been isolated, barbed wire transformed how land could be used and defended, and industrialization moved production from manual craft to mechanized scale. Each of these breakthroughs made entire categories of skills obsolete within a single generation. For him, AI represents the same kind of structural shift, but one that is unfolding in markets and information processing rather than physical infrastructure.

Frontier vs. Civilization

He also uses the metaphor of the American frontier to describe how technology adoption works. Startups are like cowboys—pushing into uncharted territory, experimenting, and breaking rules. Larger institutions, by contrast, act as the builders of civilization: they bring order, scale, and governance once the frontier is established. England sees AI as today’s frontier. The first movers push boundaries with speed and experimentation, while established firms like Walleye have to balance that frontier spirit with the resources and discipline needed to operate at scale.

Acceleration of Change

The most striking difference, in England’s view, is the pace. Railroads and industrial infrastructure took decades to build out. Entire lifetimes could pass with people adapting gradually to new technologies. AI is moving much faster. Shifts that once unfolded over a generation are now being compressed into a few years. For a hedge fund competing in real time, that means adaptation is no longer optional—it’s urgent. Firms that hesitate risk being left behind before they even realize the ground has shifted.

Q7: How is AI changing Will England’s personal workflow?

Bullet Points to Polished Prose

England explained that he thinks best when he writes out his thoughts. In practice, he now begins important memos or emails by jotting down bullet points—what he’s thinking, why it matters, and the context around it. He then feeds that outline into a large language model, often along with prior material he’s written on the same subject, and asks the system to draft the communication in his own voice. This workflow means he can focus on ideas while the model handles the mechanics of stitching sentences together.

Time Savings

This shift has cut hours off his process. Lengthy memos that once might have taken four or five hours can now be finished in 15 minutes. For someone in a leadership role where communication is constant—whether with employees, investors, or counterparties—that time savings adds up quickly and allows him to spend more of the day on higher-order decisions rather than wordsmithing.

Sharper Thinking

England is clear that using AI doesn’t dilute his thinking. Quite the opposite—he finds it clarifies it. By separating conceptual work from linguistic polish, he avoids getting bogged down in sentence structure or stylistic flourishes. He pointed out that much of writing is really “the tying your shoes part,” and letting a model handle that frees him to sharpen the concepts he wants to convey. The result, in his view, is clearer and more effective communication.

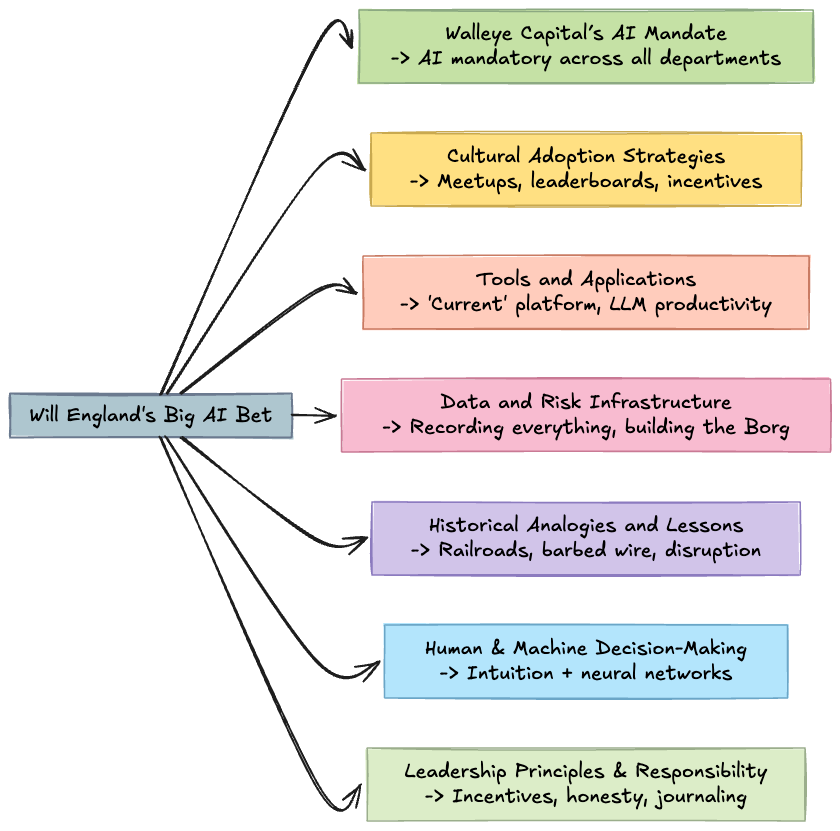

Mind Map

I. Walleye Capital’s AI Mandate

A. Organizational Shift

AI usage made mandatory for all 400 employees.

Applies to all departments—investment, compliance, accounting, legal.

Framed as equivalent to refusing the internet in 1995.

B. Leadership Role

Will England leads by example, positioning himself as “chief AI evangelist.”

Responsibility extends to employees, investors, and broader ecosystem.

II. Cultural Adoption Strategies

A. Social Structures

Weekly AI meetups for sharing use cases and prompts.

Firm-wide AI usage leaderboards to encourage competition.

Incentives for suggesting tools adopted across the firm.

B. Overcoming Fear and Resistance

Messaging that AI use is not “cheating.”

Normalization of imperfect tools—public demos even when flawed.

Emphasis on experimentation and accessibility.

III. Tools and Applications

A. Internal Platform: “Current”

Synthesizes analyst notes, broker reports, transcripts.

Critical during earnings periods; provides real-time analysis.

Widely viewed as indispensable by portfolio managers.

B. Productivity Enhancements

Large language models (LLMs) used for communication, writing memos, and emails.

Drafting shifts from hours to minutes, freeing time for higher-level tasks.

C. Quantitative Strategies

Longstanding use of advanced statistics and sentiment analysis.

Integration of unstructured data with LLMs.

IV. Data and Risk Infrastructure

A. Recording and Collective Memory

Nearly all calls and meetings recorded.

Built toward a “Borg”-like collective data lake for firm-wide memory.

Enables LLMs to provide retrospective insights and risk monitoring.

B. Governance and Risk Management

Recorded data supports oversight and predictive risk processes.

AI embedded into daily risk calls and control center activities.

V. Historical Analogies and Lessons

A. Technological Disruption

Comparisons to railroads, barbed wire, and industrialization.

Past innovations rapidly made old skills obsolete.

B. Frontier vs. Civilization

Cowboy era and frontier metaphor: individual exploration vs. structured systems.

Parallel to startups vs. institutionalized firms in technology adoption.

VI. Human and Machine Decision-Making

A. Human Nature and Patterns

Human nature seen as timeless, shaping markets across centuries.

Investing blends repeating patterns and human-driven intuition.

B. Intuition and Neural Networks

Neural networks and human intuition both operate in high-dimensional spaces.

Machines complement intuition by surfacing unexpected but intuitive patterns.

VII. Leadership Principles and Responsibility

A. Decision-Making Anchors

Core principles: incentives and intellectual honesty.

Journaling and tracking personal metrics reinforce self-evaluation.

B. Journaling with AI

Daily reflections across family, work, and health categories.

Reduced friction with AI: 30 seconds to capture and process.

C. Responsibility Layers

To investors: maximize returns responsibly.

To employees: prepare them for disruption and change.

To family: model adaptability and stewardship.

Disclaimer: The information contained in this newsletter is intended for educational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions. Additionally, please note that we at AInvestor may or may not have a position in any of the companies mentioned herein. This is not a recommendation to buy or sell any security. The information contained herein is presented in good faith on a best efforts basis.