The Disappearing Edge: AI, Machine Learning, and the Future of the Discretionary Portfolio Manager

Community Wisdom - Sharing the best that we find

“Our aim is not to forecast the obsolescence of the PM, but rather to understand the conditions under which the role can continue to deliver value.” —Fabozzi et al.

Introduction

I recently came across a paper that speaks to much of what my career has been about—using computers, code, data, and ideas to generate returns: The Disappearing Edge: AI, Machine Learning, and the Future of the Discretionary Portfolio Manager by Frank J. Fabozzi, Andrew Chin, Igor Yelnik, and Jim Liew. Their practical approach and understanding of the continuum between systematic and discretionary is what caught my attention. Human judgment isn’t going away, though, but when, where, and how it’s applied will evolve. I’d be inclined to call it the changing edge rather than disappearing.

Abstract

The discretionary portfolio manager’s role is evolving as artificial intelligence and machine learning increasingly supplement or replace traditional investment insight. This article explores how advances in large language models and deep learning are narrowing the discretionary edge once defined by judgment and narrative skill. A new model is emerging in which the portfolio manager acts as an allocator and model steward, rather than a sole decision-maker. We examine the implications for governance, performance, and risk and argue that firms that retool talent, workflows, and oversight may be best positioned to harness the promise—and manage the limits—of AI-driven asset management.

What follows are three styles of summaries we use to highlight and profile work we believe is especially relevant to investors today. Each offers a different angle on the material. Any shortcomings or errors are ours.

One of our motivations for starting AInvestor was to create a reason to actively engage with AI in an operational setting—learning by doing. I maintain active editorial oversight of instruction, model, and platform choices, but almost everything in the summaries below was written by AI. In the context of what we’re doing, I see this as a feature, not a bug. By experiencing the highs, and yes, the lows, we can better understand both the possibilities and the limitations of this new generation of AI.

Click above to access a custom GPT we spun up to help clean up our own writing. It’s designed to apply the lightest of touches. If you’re a paying ChatGPT customer, it’s free to use (we don’t get a cut). Feel free to play around with it as much as you’d like.

Learnings & Takeaways

1. The discretionary edge is being redefined

Author’s words: “The edge once associated with discretionary judgment may no longer reside in the decision itself, but in how PMs frame, interpret, and adapt machine-generated insights.”

Asset management context: Core skills like interpreting earnings calls or reading sentiment are increasingly automated. The PM’s value shifts to model calibration, governance, and contextual judgment.

Our add: A new source of edge will come from knowing when to accept it’s better to step back and let the computer do the work, and when it is appropriate to override.

2. Discretionary vs. systematic is a spectrum

Author’s words: “No investment strategy is entirely devoid of either discretion or structure.”

Asset management context: LLMs allow discretionary PMs to scale breadth and systematic managers to add qualitative nuance. The line between styles is now blurred.

Our add: This spectrum has always been so, at least in the forty years we’ve been involved. What’s changing is variability in decisions–which is the essence of discretion–which the new AI-powered tools will increasingly be made a choice, not an artifact of circumstances.

3. Hybrid PM models are often superficial

Author’s words: “Hybrid frameworks only succeed when discretionary and quantitative teams collaborate closely, share outputs, and have mutual accountability.”

Asset management context: Many PMs use quant tools only when they confirm existing views, ignoring conflicting signals. True integration requires cultural, governance redesign.

Our add: We’ve been involved in projects attempting to achieve synergies between the discretionary and systematic–it is hard. In addition to the considerations covered in the paper, the requirements around data and other inputs differ across the two dimensions. There is a whole article for us to write on these differences, why and how they matter.

4. AI is eroding the last bastions of human intuition

Author’s words: “AI models may soon rival discretionary PMs in their ability to anticipate discontinuities.”

Asset management context: Regime shifts, once the hallmark of human intuition, are now detectable through models trained on diverse, unstructured signals.

Our add: Regime identification and correctly anticipating change is the holy grail. We’ll take whatever help we can get.

5. Complexity creates credibility risks

Author’s words: “Model opacity can hinder the ability to perform robust performance attribution and risk oversight.”

Asset management context: Complex ML may outperform, but without interpretability, fiduciaries struggle to defend exposures to boards, consultants, or regulators.

Our add: Few things are less transparent than the real reasons behind a discretionary trader’s decisions. We supported one of the best for two decades; stylized explanations are the best you should typically expect. And it’s not like they are trying to hide anything. Optimistically, AI will facilitate creating credible audit trails (we address this with Michael Mauboussin in our discussion here).

6. Institutional readiness determines success

Author’s words: “Realizing these benefits depends on institutional readiness, not just technological capability.”

Asset management context: Dashboards and overlays alone don’t change outcomes. Firms must retool workflows, governance, and talent development for AI to be transformative.

Our add: Knowing what your “good” looks like determines success. Good process, good data, good IP, good governance, good incentives, and more.

FAQs

Q1: How is the role of the discretionary portfolio manager (PM) changing in the age of AI?

From Decision-Maker to Model Steward

The article makes clear that the PM’s traditional role—making conviction calls based on qualitative judgment—is shrinking. AI now handles tasks like parsing earnings calls, summarizing filings, and mapping sentiment across assets. That leaves the human with oversight functions: interpreting machine output, calibrating signals to liquidity and risk budgets, and deciding when to override.

Context for Asset Managers

This isn’t a minor shift. In practice, a PM’s daily work increasingly resembles editing, curating, and translating model results rather than originating every idea. Firms that cling to the “star manager intuition” model will underperform firms that redefine PMs as model stewards.

Q2: Is the distinction between discretionary and systematic strategies still valid?

A Spectrum, Not a Split

The authors argue the binary is outdated. Every “discretionary” manager now uses quantitative tools, and every “systematic” manager makes discretionary choices in model design and parameter setting.

Practical Implications

For allocators and consultants, the relevant question isn’t “Is this discretionary or systematic?” but “Where does it sit on the spectrum, and how are human and machine inputs combined?” Discretionary PMs are now using LLMs to scale breadth across universes, while systematic managers use AI to add qualitative nuance. The edge comes from the integration design, not the label.

Q3: What is the reality of the “hybrid PM” model?

Superficial Integration Is the Norm

Many firms talk up “hybrid” approaches, but the paper shows that most implementations are shallow. Quant screens or sentiment dashboards are bolted on, and PMs selectively use them when they align with their priors. This is confirmation filtering, not integration.

Why Most Firms Get Stuck

The sticking point is governance and incentives. If accountability remains tied to the discretionary PM alone, then quant inputs will always be treated as optional. True hybridization requires reassigning decision rights and creating joint accountability between discretionary and quantitative staff. Without that, the “hybrid PM” is more myth than practice.

Q4: Can AI fully replace human intuition, especially during regime shifts?

AI Closing the Gap

The article notes that regime detection—once a human edge—is being eroded. Models trained on unstructured data (policy announcements, commodity flows, social sentiment) now flag early signs of discontinuity. These signals often surface before humans recognize them.

Remaining Human Role

Still, machines are not yet fully reliable in low signal-to-noise environments or under unprecedented shocks. Human oversight matters in spotting spurious correlations, contextualizing geopolitical nuance, and deciding when to discard model output. The edge is no longer “intuition versus machine” but “intuition applied to supervising the machine.”

Q5: What risks do complex machine learning models create?

Opacity as a Fiduciary Problem

High-dimensional ML models can improve out-of-sample prediction and Sharpe ratios. But they are often black boxes. When exposures can’t be explained, fiduciaries cannot defend them to boards, consultants, or regulators.

Governance and Accountability

Opacity also clouds accountability. If a model misfires, is the fault with the PM who accepted the output or the quant team who built it? Without interpretability tools and audit trails, performance attribution and risk oversight break down. The paper argues that complexity is acceptable only if paired with transparency frameworks like feature attribution and robust documentation.

Q6: What skills must tomorrow’s PMs develop?

Model Literacy as a Core Competency

The paper emphasizes that future PMs don’t need to code neural nets but must understand how models fail. This includes recognizing overfitting, model drift, and constraint violations.

Cross-Disciplinary Integration

The winning PM profile blends market expertise with technical fluency. They must translate model outputs into investment decisions that respect liquidity, regulation, and client mandates. Firms that treat PMs as “market-only experts” risk falling behind.

Q7: What should asset management firms do to adapt?

Beyond Dashboards and Overlays

Superficial adoption—dashboards, sentiment screens, or GenAI summaries—does not change outcomes. The authors stress that genuine adaptation requires embedding models in rebalancing, signal weighting, and transaction cost management.

Organizational Redesign

That means iterative feedback loops between quants and PMs, shared attribution of performance, and protocols for model ownership and override. Talent development must include prompt engineering and fine-tuning, with PMs contributing labeled data from their judgment process. Firms that fail to retool incentives and governance will be left with symbolic AI, not competitive AI.

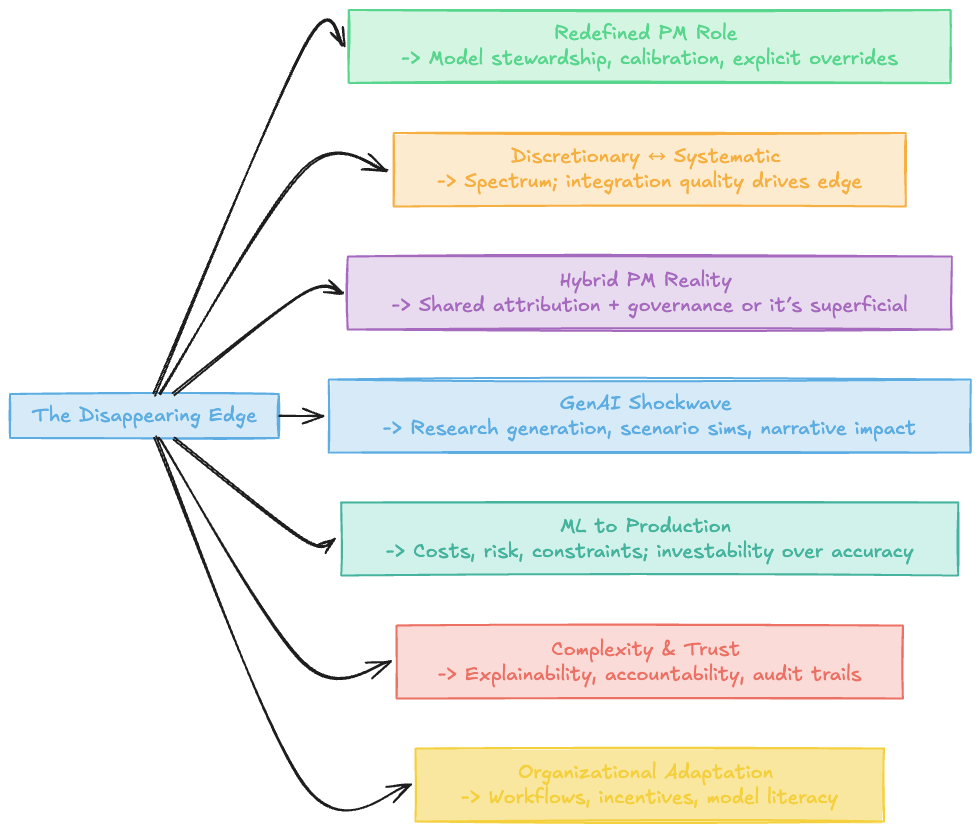

Mind Map

I. The Disappearing Edge: AI, Machine Learning, and the Future of the Discretionary Portfolio Manager

Purpose: Explore how AI and ML are reshaping discretionary portfolio management.

Key Theme: The role of the PM is shifting from decision-maker to curator, interpreter, and steward of models.

II. Discretionary vs. Systematic: The Borderline

A. Traditional Definitions

Discretionary: Relies on human judgment, experience, qualitative/quantitative inputs.

Systematic: Driven by models with limited human intervention.

B. Continuum, Not a Dichotomy

All strategies contain elements of both.

Boundaries are blurring with AI/LLM integration.

C. Practical Differences

Systematic: backtesting, attribution, structured risk controls.

Discretionary: adaptable but inconsistent, harder to scale.

D. Grinold Fundamental Law

Discretionary = depth (high IC, low breadth).

Systematic = breadth.

AI increases breadth for discretionary, depth for systematic.

III. From Edge to Erosion

A. Historical Edge

Human ability: tone, sentiment, subtle shifts, intuition.

B. AI’s Capabilities

Parse transcripts, detect contradictions, infer policy directions.

Faster, scalable, cost-effective.

C. Human Relevance

Still strong in low signal-to-noise and regime shifts.

Edge shifting to framing and interpreting machine insights.

IV. The Myth of the Hybrid PM

A. Concept

Human + machine = best of both worlds.

B. Reality

Often superficial integration.

Confirmation filtering: use models when aligned, ignore otherwise.

C. Structural Barriers

Legacy incentives and accountability.

D. Stronger Models

True hybrid = redesign roles, workflows, and accountability.

Example: “Iron-person” PM curating signals and narratives.

V. Where the Edge Used to Be and Where It Is Going

A. Past Sources

Interpreting qualitative signals, spotting regime changes.

B. AI Encroachment

LLMs summarizing, DL uncovering nonlinearities.

AI starting to handle regime detection.

C. New Human Value

Oversight, interpretation, refining assumptions, contextualizing outputs.

VI. Lessons from the Machine Learning Literature

A. Early Findings

Nonlinear ML > linear models in prediction.

B. Practical Limitations

Predictive accuracy ≠ investability.

Need governance, explainability, transaction cost integration.

C. Dimensionality & Complexity

Reduce overfitting via dimensionality reduction.

Balance complexity with interpretability.

D. NLP & GenAI

Extend ML into unstructured data (earnings calls, filings, news).

E. Implications for PMs

Interpretation and application > raw generation.

Fluency with models critical.

VII. The GenAI Shockwave

A. Unique Capabilities

Generate text, simulate scenarios, interpret qualitative data.

B. Applications

Draft research, translate macro, test judgments.

C. Implications

Challenges PM narrative role.

Enhances efficiency, assumption testing, documentation.

VIII. Redefining the Edge from Discretion

A. Past Role

Synthesizer of info, conviction builder.

B. New Role

Model calibration to constraints.

Oversight, integration, validation.

C. Talent Shift

PMs need model fluency, cross-disciplinary integration.

IX. The Virtue of Complexity? Or a Crisis of Credibility?

A. Complex Model Promise

Nonlinear, high-dimensional patterns = performance gains.

B. Caveats

Dependent on methodology, diminishing returns in noisy settings.

C. Governance Challenges

Complexity = opacity.

Problems of accountability, interpretability, client communication.

D. Balanced View

Complexity useful if responsibly managed with explainability.

X. Adapting or Disappearing: What Firms Need to Do Now

A. Superficial vs. Deep Integration

Dashboards/overlays vs. core process redesign.

B. Organizational Changes

Shared attribution, iterative feedback loops.

Talent: model literacy, prompt engineering, fine-tuning.

C. Governance

Protocols for ownership, overrides, escalation, auditability.

D. Bottom Line

Institutional readiness > tech capability.

Superficial adopters risk irrelevance.

XI. Conclusion: When the Machine Becomes the PM

A. Redefined Human Role

Editors, curators, translators of model output.

B. Firm-Level Practices

Embed ML into core, foster cross-functional collaboration.

C. Success Factors

Interpretability, constraint calibration, governance alignment.

D. Future of Discretion

Traditional edge eroded.

New edge = model supervision, validation, stewardship.

Notes on contributors

Frank J. Fabozzi

Frank J. Fabozzi is a Professor of Practice in Finance at Carey Business School, Johns Hopkins University, Baltimore, Maryland.

Andrew Chin

Andrew Chin is the Chief AI Officer and the previous Head of Investment Solutions and Sciences, Chief Risk Officer, and Head of Quantitative Research at AllianceBernstein LP in New York, New York.

Igor Yelnik

Igor Yelnik is the Founder, Chief Executive Officer, and Chief Investment Officer at Alphidence Capital Ltd., London, United Kingdom.

Jim Liew

Jim Liew is an Associate Professor of Practice in Finance at Carey Business School, Johns Hopkins University, Baltimore, Maryland.

References

Bartram, Söhnke M., Jürgen Branke, and Mehrshad Motahari. 2020. Artificial Intelligence in Asset Management. CFA Institute Research Foundation.

Blitz, David, Thijs Hoogteijling, Harald Lohre, and Patrick Messow. 2023. “How Can Machine Learning Advance Quantitative Asset Management?” The Journal of Portfolio Management 49 (9): 78–95.

Buncic, Daniel. 2025. “Simplified: A Closer Look at the Virtue of Complexity in Return Prediction.” SSRN Working Paper

Bybee, Alexander. 2024. “Ghost in the Machine: AI Misalignment and the Limits of Model Control.” Ethics and AI Quarterly, forthcoming

Cartea, Álvaro, Qianjin Jin, and Yichen Shi. 2025. “The Limited Virtue of Complexity in a Noisy World.” SSRN Working Paper

Chen, Liyun, Markus Pelger, and Juanyi Zhu. 2024. “Deep Learning in Asset Pricing.” Management Science 70 (2): 714–750.

Chin, Andrew. 2025. “Leveling the Divide Between Discretionary and Systematic Investing: How AI Enables Breadth and Depth.” The Journal of Portfolio Management 51 (6): jpm.2025.1.730.

Grinold, Richard C. 1989. “The Fundamental Law of Active Management.” The Journal of Portfolio Management 15 (3): 30–37.

Gu, Shihao, Bryan Kelly, and Dacheng Xiu. 2020. “Empirical Asset Pricing via Machine Learning.” The Review of Financial Studies 33 (5): 2223–2273.

Kelly, Bryan, Semyon Malamud, and Kien Zhou. 2024. “The Virtue of Complexity in Return Prediction.” Journal of Finance 79 (1): 459–503.

Kirtac, Kemal, and Guido Germano. 2024. “Sentiment Trading with Large Language Models.” Finance Research Letters 62: 105227.

Kozak, Serhiy, Stefan Nagel, and Shrihari Santosh. 2020. “Shrinking the Cross-Section.” Journal of Financial Economics 135 (2): 271–292.

Lopez-Lira, Ariel, and Yuehua Tang. 2023. “Can ChatGPT Forecast Stock Price Movements?” SSRN Working Paper.

Rudin, Alexander, Igor Yelnik, Juan Antolin–Diaz, Frank J. Fabozzi, and Suhail Shaikh. 2025. “From Economics to AI: Integrating Discretionary and Quantitative Approaches in Asset Management.” The Journal of Portfolio Management 51 (1): jpm.2025.1.737.

Yelnik, Igor. 2016. “On the Style Edge: Discretionary vs. Systematic.” The Hedge Fund Journal 116.

Disclaimer: The information contained in this newsletter is intended for educational purposes only and should not be construed as financial advice. Please consult with a qualified financial advisor before making any investment decisions. Additionally, please note that we at AInvestor may or may not have a position in any of the companies mentioned herein. This is not a recommendation to buy or sell any security. The information contained herein is presented in good faith on a best efforts basis.